A bond is a security that pays a known income (the coupon) for a given period of time (the term) and repays the face value of the security at maturity.

A bond is simply a loan or an IOU from the investor to the government, bank or corporation (known as the issuer). Think of the loan you take out from the bank to buy a house. The bank expects to be repaid interest and principal. If you fail to make the payments you break the contract and the bank has rights to recover its funds.

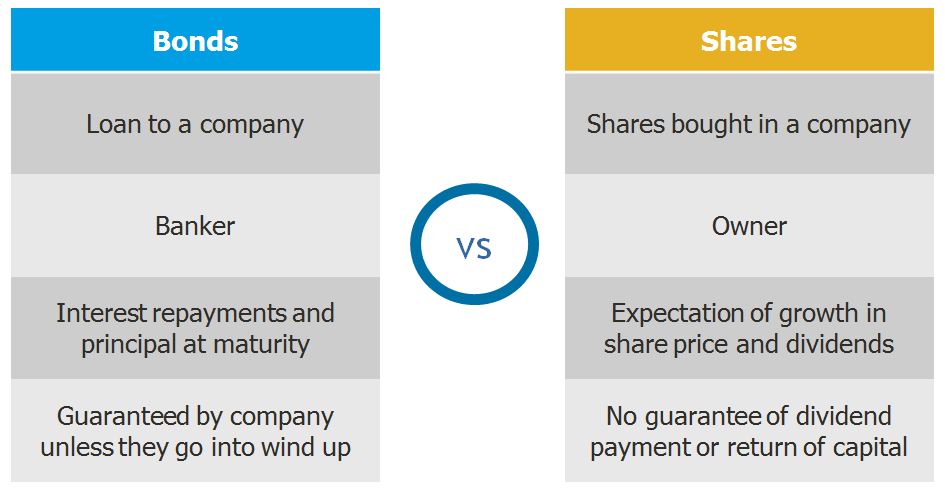

Bonds work in much the same way. The investor agrees to lend the money to the issuer who must then honour that legal obligation by paying back interest and principal. If repayments are not made on time then the entity will be in default. This is an important benefit over shares (equity), where investors own part of the company. While there is no avenue for non-payment of interest and principal to bond investors, companies can reduce or eliminate dividend payments to shareholders altogether. This feature is important for investors seeking a regular, known income (see the diagram below).

Source: FIIG Securities Limited

What are the benefits of investing in bonds?

- Capital stability: Bondholders have priority over equity holders in the event of liquidation (see the corporate capital structure diagram below). Assuming the issuer of a bond remains solvent, they are contractually obliged to pay back the principal value to the bondholder.

- Regular income: Fixed income securities provide a regular income stream through coupon (interest) payments.

- Diversification: Holders of fixed income securities enjoy diversification from the two most highly cyclical asset classes: equities and property.

- Higher returns than deposits: Many investors use term deposits which are very low risk but generally earn relatively low returns. By moving slightly down the bank issuer's capital structure into bonds (senior or subordinated debt) investors can retain their exposure to the issuer but earn a higher return.

- Liability management: Typically, bond maturities vary from one to ten years and can be traded before maturity to meet commitments.

- Liquidity: Low risk, highly liquid fixed income investments like government bonds can be sold at short notice if needed. Bank and corporate bonds are typically very liquid but may not be as liquid as government bonds.

- Downturn protection: Generally, a fixed income allocation will act to protect your portfolio during a cyclical downturn, in that unless the issuer goes into wind-up, you will be assured of your interest payment (coupon) and capital repayment at maturity. Fixed rate bonds, where the rate is fixed at the time of issue (much the same as fixing your mortgage rate) provide greater protection in a cyclical downturn, where interest rates are lowered to try and stimulate the economy. Locking in a fixed return when interest rates decline (the circumstances where you would expect the share and property markets to decline) offers excellent protection to your portfolio.

What are some of the risks to investors?

There are two key risks when investing in bonds:

- Credit risk: The risk that an issuer may be unable to meet the interest or capital repayments on the bond when they fall due. Generally, the higher the credit risk of the issuer, the higher the interest rate that investors will expect in order to risk lending funds to the issuer (as demonstrated in the capital structure diagram below).

Source: FIIG Securities Limited

- Interest rate risk: The risk associated with an interest bearing asset, such as a bond, due to variability of interest rates. There is an inverse relationship between fixed interest rates and price. When interest rates fall, prices of fixed rate bonds rise and vice-a-versa. This risk is not present in floating rate notes (FRNs), which as the name implies, have the coupon or interest payments linked to a floating benchmark, typically the 90 day bank bill swap rate or BBSW.

In conclusion, bonds are safer than equities in the same company as they sit higher in the capital structure. In stressed market conditions, investments that sit low or lowest in the capital structure and are highest risk will show more volatility than the lower risk investments such as senior debt, which sits higher in the capital structure (as shown in the above diagram).

Common terms

Issuer is the entity (or borrower) that issues the bond to raise money from investors. Issuers in the Australian bond market include the Commonwealth Government, state governments and territories, financial institutions and corporations.

Maturity is the date when the bond is due for repayment by the issuer. The principal plus any outstanding interest of a particular security will be repaid on this date.

Face value is the initial capital value of the bond and the amount repaid to the bondholder on its maturity, usually par or $100.

Coupon is the rate of interest paid on a bond. Coupons can be paid annually, semi-annually or quarterly or as agreed in the terms of the bond.

'Want to learn more about corporate bonds, but don't know where to get started? Get started with our Corporate Bonds Education Hub to get ahead today.

Looking for the next step? Why not attend a seminar or webinar. Click here to register.